How Much Mortgage Can You Really Afford Each Month?

Posted on Feb 06, 2023 in Buying

How to Get the Best Mortgage Series – Week 2

Follow this series to learn how to get the best mortgage for your specific financial situation and goals. You’ll see what steps you need to take throughout this process to make it productive and successful!

It’s all about what you can afford each month before you determine a price range!

As discussed last w...

Property tax assessment value vs. Home sale price

Posted on Jan 23, 2023 in Homeowner

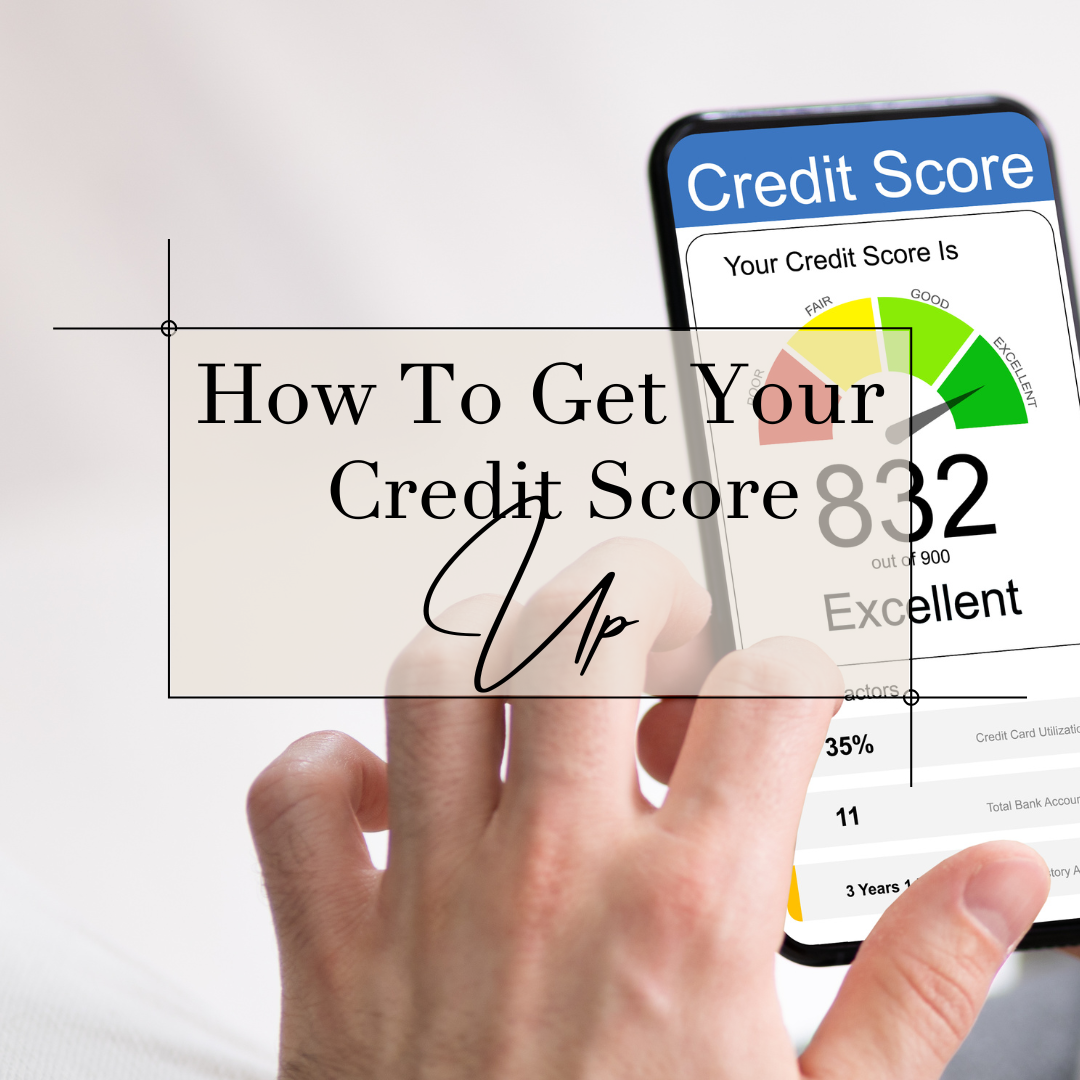

The 10 “Credit Score” Commandments

Posted on Jan 16, 2023 in Buying

How to Get Your Credit Score Up — Week 4

This series shines a light on the importance of your credit score when buying a home. Most buyers need to take out a mortgage, and that’s when your finances become an open book. Lenders will need to gauge if you’re worth the risk to lend you money, and this series will help you learn some important strategies...

3 Common Mistakes that Lower Credit Scores

Posted on Jan 09, 2023 in Buying

How to Get Your Credit Score Up — Week 3

Having a high credit score is important all the time, whether you are buying a home anytime soon or not. Your credit score and credit report are so vital to getting any type of loan, and this series will give you the financial strategies you need to get your credit score as high as possible.

Whether you know i...

Before You Make Extra Mortgage Payments, Read This

Posted on Dec 12, 2022 in Homeowner

I’ve been having a lot of conversations about mortgages lately.

Conversations about refinancing, loans that help my clients buy and sell simultaneously, and whether it makes sense to pay off your mortgage early or even make extra payments if you have additional funds.

I love talking about mortgages and how they can be a financial tool to help make y...

How to Get Your Credit Score Up

Posted on Dec 12, 2022 in Buying

Demystifying Your Credit Score— Week 2

Having a high credit score is important all the time, whether you are buying a home anytime soon or not. Your credit score and credit report are so vital to getting any type of loan, and this series will give you the financial strategies you need to get your credit score as high as possible.

There’s one number...